Search This Blog

Tuesday, May 31, 2011

BASF SE Declares Force Majeure

BASF SE declares Force Majeure for supplies of Butanediol and Butanediol Derivatives out of its production plants in Ludwigshafen.

Old World Industries Announces Price Schedule May/June

MEG values have been volatile in Asia as a result of unplanned supply disruptions in Taiwan and pending maintenance outages the Middle East. The document below outlines the North America maintenance schedule for May and June.

Ashland buying International Specialty Products

LONDON (MarketWatch) -- Specialty-chemicals group Ashland Inc. ASH +6.96% said Tuesday that it will acquire closely-held International Specialty Products Inc. in a $3.2 billion all-cash deal. "ISP's advanced product portfolio will expand Ashland's position in high-growth markets such as personal care, pharmaceutical and energy," Ashland said in a statement. For the fiscal year ended March 31, International Specialty Products generated sales of $1.6 billion and earnings before interest, taxes, depreciation and amortization of $360 million. Ashland said the deal is expected to be immediately accretive to its earnings per share and is expected to close before the end of the September quarter.

Labels:

Ashland,

International Specialty Products

Monday, May 30, 2011

Thursday, May 19, 2011

Sunoco Selling Frankford Plant to Honeywell

Sunoco Inc. announced Wednesday it was selling its Frankford phenol and acetone plant for $85 million, the latest asset divestiture by the Philadelphia refiner.

The buyer, Honeywell International Inc., says it will keep the 162 employees at the manufacturing facility.

"We do expect to add some positions within both the production and supply chain areas, as well as key functional support areas," Honeywell spokesman Peter Dalpe said.

Phenol is a raw material used in manufacturing nylon. The Frankford plant supplies a Honeywell plant in Virginia, Dalpe said.

The buyer, Honeywell International Inc., says it will keep the 162 employees at the manufacturing facility.

"We do expect to add some positions within both the production and supply chain areas, as well as key functional support areas," Honeywell spokesman Peter Dalpe said.

Phenol is a raw material used in manufacturing nylon. The Frankford plant supplies a Honeywell plant in Virginia, Dalpe said.

Tuesday, May 17, 2011

BASF Declares Force Majeure on TDI

May 17, 2011

Dear Valued Customer,

The severe flooding of the lower Mississippi river and surrounding areas is

limiting raw materials from being delivered into our Geismar, Louisiana

production facilities.

As a result, BASF is declaring force majeure on all toluene diisocyanate

(Lupranate T80 and Lupranate 8020) products effective immediately.

Retroactive beginning May 1,2011, deliveries of products will be allocated on

a fair and reasonable basis utilizing the past 6 month (Nov 2010 -April 2011)

purchases for the base.

Your sales representative will be in touch with you to discuss the situation in

more detail.

We appreciate your patience as we work through this very difficult time.

Dear Valued Customer,

The severe flooding of the lower Mississippi river and surrounding areas is

limiting raw materials from being delivered into our Geismar, Louisiana

production facilities.

As a result, BASF is declaring force majeure on all toluene diisocyanate

(Lupranate T80 and Lupranate 8020) products effective immediately.

Retroactive beginning May 1,2011, deliveries of products will be allocated on

a fair and reasonable basis utilizing the past 6 month (Nov 2010 -April 2011)

purchases for the base.

Your sales representative will be in touch with you to discuss the situation in

more detail.

We appreciate your patience as we work through this very difficult time.

Monday, May 16, 2011

Lyondell Announces Increases for Propylene Carbonate

Effective June 1st, 2011, Lyondell Chemical will increase the list and off-list selling price for Propylene Carbonate.

Labels:

Lyondell,

PC,

Price Increases,

Propylene Carbonate

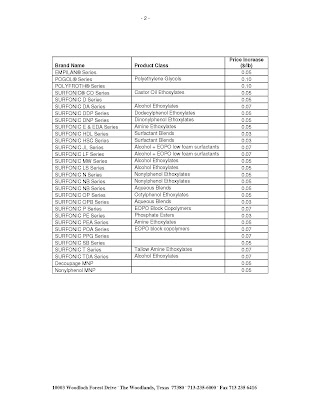

Sasol Announces Price Increases

Effective June 1st, 2011, Sasol Chemicals North America will increase prices for the following products, not to exceed list price.

Friday, May 13, 2011

Eastman Announces Sales Plan

Eastman has announced sales plans for the following products effective immediately. Orders from May 1 through today will be included in the monthly allocation numbers.

* n-Butyl Alcohol – 100% sales plan based of last 6 months history (November 1, 2010 – April 30,2011)

*2-EH Acid – 80% sales plan based on last 12 months history (May 1, 2010 – April 30, 2011)

*n-Butyl Acetate – 100% sales plan based on last 12 months history (May 1, 2010 – April 30, 2011)

*n-Propyl Acetate – 80% sales plan based on last 12 months history (May 1, 2010 – April 30, 2011)

*n-Propyl Alcohol – 80% sales plan based on last 12 months history (May 1, 2010 – April 30, 2011)

This action is necessary due to overall tightness in the market and competitor announced sales allocation. The plans will allow us to control demand in line with our supply capability.

Although not a reason for the sales allocations, the situation with the Mississippi River flooding will likely impact transit of railcars across the US, which could also cause shortage of product and or raw materials.

* n-Butyl Alcohol – 100% sales plan based of last 6 months history (November 1, 2010 – April 30,2011)

*2-EH Acid – 80% sales plan based on last 12 months history (May 1, 2010 – April 30, 2011)

*n-Butyl Acetate – 100% sales plan based on last 12 months history (May 1, 2010 – April 30, 2011)

*n-Propyl Acetate – 80% sales plan based on last 12 months history (May 1, 2010 – April 30, 2011)

*n-Propyl Alcohol – 80% sales plan based on last 12 months history (May 1, 2010 – April 30, 2011)

This action is necessary due to overall tightness in the market and competitor announced sales allocation. The plans will allow us to control demand in line with our supply capability.

Although not a reason for the sales allocations, the situation with the Mississippi River flooding will likely impact transit of railcars across the US, which could also cause shortage of product and or raw materials.

Thursday, May 12, 2011

ARCH Chemicals Price Increase

Labels:

ARCH Chemicals,

DPG,

DPM,

MPM,

PG,

Price Increases,

TM,

TPG,

TPM

Wednesday, May 11, 2011

Shell Announces Price Increases

Effective June 1st, 2011, Shell Chemicals LP will increase prices as follows:

Methyl Proxitol (PM), Methyl Di-Proxitol (DPM), Methyl Proxitol Acetate (PMA), and Ethyl Proxitol (EP).

Methyl Proxitol (PM), Methyl Di-Proxitol (DPM), Methyl Proxitol Acetate (PMA), and Ethyl Proxitol (EP).

Monday, May 9, 2011

Lyondell Announces Price Increases

Effective June 1st, 2011, Lyondell will increase by seven cents per pound the list and off-list prices for all grades of Propylene Glycol and Dipropylene Glycol.

Friday, May 6, 2011

Lyondell Chemical Announces Price Increases

Effective June 1st, 2011, Lyondell Chemical Company and Equistar Chemicals, LP will increase off-list and list prices for the following solvents.

Labels:

Equistar Chemical,

Lyondell,

Price Increases,

Solvents

Tuesday, May 3, 2011

Dow Increase List & Off-List Products

Effective June 1st, 2011, The DOW Chemical Company will increase list and off-list selling prices on select products within the Oxygenated Solvents portfolio.

ExxonMobil Announces Price Increase

Effective May 18th, 2011, Exxon Mobil Chemical Company will increase its selling prices for all branched alcohol based JAYFELX Plasticizer phthalate, adipate, benzoate, and trimellitate grades by eight (8) cts/lb.

Monday, May 2, 2011

Force Majeure in Asia: Asian spot Styrene, Ethylene prices firmer from early April levels

In Asia, spot styrene and ethylene costs recorded increases in the month of April with support from strong oil prices that continue to hover above US$100/bbl, as per Chemorbis.

Looking at spot figures, Asian styrene prices gained US$120/ton increases on FOB Korea basis when compared to the beginning of April, supported by firming oil prices, amid strong styrene demand coming from China. Meanwhile, shutdowns and lower operating rates also played a role in the rise seen on styrene prices.

South Korea’s LG Chem shut down three styrene plants for a planned turnaround, and withdrew offers from the spot market in March-April. Presently, these plants are reported to have restarted and running at full capacity. However, since the company has just emerged from a turnaround, it is not expected to provide spot styrene to the market during May.

Meanwhile, Ellba-Eastern, a Shell and BASF joint venture, had declared force majeure on its 550,000 tpa styrene monomer/propylene oxide plant in Singapore, which was shut on March 22. The plant was restarted in mid-April and is reportedly running at 60-80% of capacity. However, the force majeure remains in place as Shell hasn’t lifted the force majeure on the output from its ethylene cracker at Pulau Bukom.Additionally, Japan Asahi Kasei lowered their operating rates by 10% compared to March during April at their 710,000 tpa styrene plant while Taiyo Petrochemical in Japan also lowered their operating rates by 20% at their 370,000 tpa styrene plant to 80% capacity.

South Korean YNCC’s 285,000 tpa styrene plant was shut at the beginning of April for four weeks maintenance while Samsung Total’s 930,000 tpa styrene plant in Korea was down for a turnaround between April 6 and May 22. During the shutdown of the company’s No.1 and No.2 plants, 80,000 tons of output is expected to be lost. In the spot ethylene market, prices did not show much change on CFR Northeast Asia basis but they gained US$125/ton on CFR Southeast Asia basis with respect to the beginning of April.

By mid-April, spot ethylene prices firmed up significantly on the back of the supply issues triggered by Shell Singapore’s prolonged shutdown at their 800,000 tpa steam cracker, where they halted their operations on March 18 due to a compressor problem. The company had initially pronounced the restart date as April 10 but later it was postponed to mid-May.

This push back on the restart date intensified the buying interest in the region and caused prices to move up. However, this situation has shifted direction during this week as spot ethylene prices eased down by US$15/ton on week over week basis since most buyers have secured some additional materials.

Yet, the cracker shutdowns continue in Asia as ExxonMobil’s 900,000 tpa cracker was shut on March 8 for 9 week of maintenance. Meanwhile, Thai PTTCH plans to halt their operations at their 400,000 tpa ethylene plant in Thailand during the first half of this year for 48 days turnaround.

Subscribe to:

Posts (Atom)